Trusts

Secure Your Future with a Legal Trusts Attorney in Ashburn, VA

Revocable living trusts are an important estate planning tool. The “revocable” nature of these trusts allows you to make revisions if your wishes change, thus granting flexibility. They are considered “living” because you, the grantor, will create your trust during your lifetime.

Revocable living trusts are an important estate planning tool. The “revocable” nature of these trusts allows you to make revisions if your wishes change, thus granting flexibility. They are considered “living” because you, the grantor, will create your trust during your lifetime.

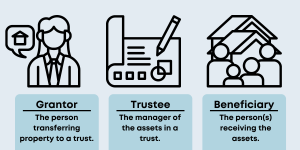

A trust involves three parties: a grantor, a beneficiary, and a trustee. The grantor is the person transferring property to a trust. At your death, the property will go to your chosen recipient(s), the beneficiary(ies). In the meantime, as trustee, you will be the legal owner of the property.

Unless life circumstances–such as an illness–leave you unable to manage your property, you may choose to be your own trustee. During your lifetime, you will also remain the equitable owner, or beneficiary, of the property in your trust. As trustee and beneficiary, you will be able to transfer to, sell, withdraw, and otherwise manage and control the assets in your trust without restriction. To ensure your trust is set up correctly and meets your needs, consult a legal trusts attorney in Ashburn, VA today.

Why Choose a Revocable Living Trust?

Revocable living trusts offer a number of benefits. They allow grantors to avoid probate, include incapacity provisions, provide privacy of your estate plan, and they can establish a trust fund for your loved ones. Read below to explore these benefits, then get connected with our Ashburn legal trust attorney for a free consultation.

Probate, or the legal process in which a will is proven to be authentic, can be time-consuming and expensive. However, since assets in a renewable living trust are transferred during the grantor’s lifetime, there will be no need for your beneficiaries to undergo the probate process. The custody, management, and distribution of assets will remain relatively simple, allowing your beneficiaries to receive their benefits sooner. In short, by choosing this trust option, you will save your loved ones a great amount of time, money, and hassle.

If you become ill, disabled, other otherwise unable to manage your affairs, a revocable living trust can give another person (or entity) the power to make arrangements for you. This person, called a successor trustee, will have direct access to the funds and assets needed for your care. Your successor trustee can, for example:

- Make sure any real estate property titled to your trust is properly insured and maintained.

- Pay outstanding bills and taxes.

- Ensure you are receiving whatever disability benefits you may be entitled to.

The revocable living trust—along with other important estate planning documents like an Advance Medical Directive and Durable Financial Power of Attorney—may let you bypass the need to petition the court for a guardian and/or conservator to protect your person and property.

Unlike a Last Will and Testament, which will become public records once qualified in court, your trust will remain private. This is because revocable trusts are not typically filed with the court. Therefore, the public will not be able to access your estate plan.

For some, privacy can be a pressing concern—for example, if a legal heir, such as a child, is not included in the estate plan. For others, privacy is simply an added benefit.

Trusts allow you to pass your wealth and assets on to your children safely, and under your own conditions. For example, you will be able to determine the age at which your child can receive his/her benefits. You will also be able to leave one or more children off of your trust if you so choose.

Upon your death, the trust fund will become available to your nominated trustee. He or she will provide benefits to your children until they reach an age determined by you, the grantor. At this point, your children can become the trustees. This will allow them to oversee investments, manage and distribute fund, and use the trust to benefit your grandchildren.

Here are a few points to keep in mind when creating your child’s trust fund:

- Assets in a properly drafted children’s trust will receive creditor protection. This will exempt them from the claims of the beneficiary’s creditors. Keep in mind, however, that the trust may still be subject to local, state, and federal taxes.

- In cases of divorce, assets in the trust may not be subject to equitable distribution. This means that if your child, the beneficiary, becomes involved in a divorce, the court will generally have no authority to award any part of the trust assets to their spouse.

- So long as the trust is drafted and administered properly, assets that remain in the trust at the time of your child’s death will not be subject to estate tax in his or her estate.

- The trust assets will not be a countable resource for Medicaid, Supplemental Security Income, or other public entitlements if the trust is properly drafted to achieve this goal.

Have additional questions? James Jaxthiemer has served as a legal trust attorney in Ashburn, VA and other areas since 2006. He is proud to serve his community by offering free, no-obligation estate planning consultations. Click here to learn more.